Top Reports for Multi-Family

These six example Kardin reports provide essential insights for multi-family property managers, combining data on projected rents, leasing activity, and potential revenue. By analyzing current tenant trends, vacancy projections, and potential rent growth, managers can strategically optimize rental income and develop targeted leasing strategies for maximizing profitability.

Also, watch this short Budget Byte video about an easy tip for drilling down in Portfolio reports. More Budget Bytes

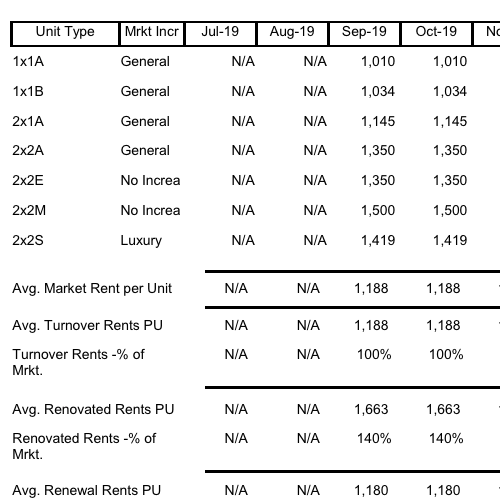

Market / Actual Rents

Offers a comparison of market rents with actual rents, along with average rents for different unit types, helping to identify rent growth opportunities.

View PDF

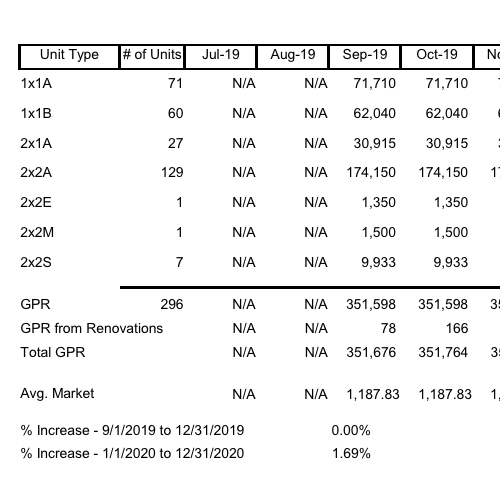

Gross Potential Rent

Provides an overview of the potential monthly rents if all units were rented at market rates, essential for gauging revenue potential.

View PDF/LossToLease.png?width=500&height=500&name=LossToLease.png)

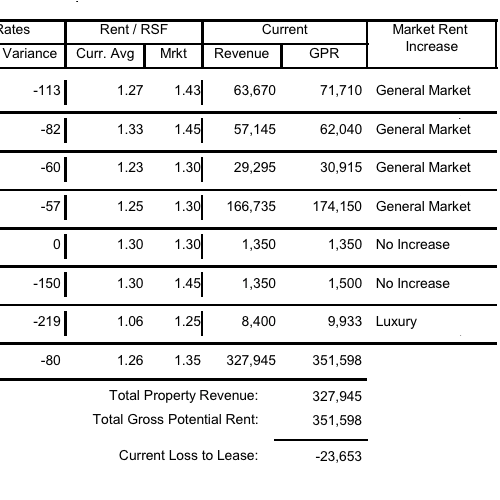

Loss to Lease

Analyzes total property revenue, factoring in losses due to concessions, rent increases, and lease turnover, helping to refine rental income strategies.

View PDF

Rent Roll

Summarizes tenant data, unit type, and rents per square foot, offering a comprehensive look at current rental income and tenant mix.

View PDF

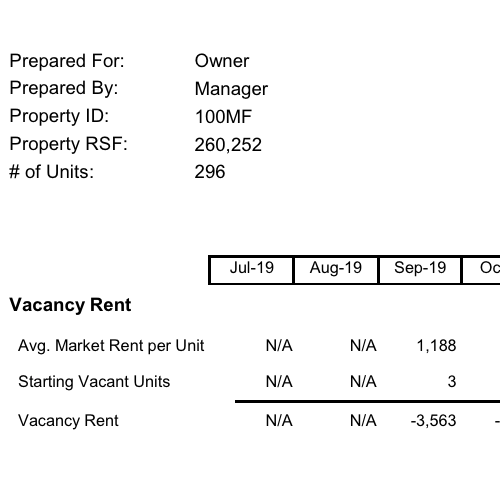

Vacancy Rents

Projects monthly market rents for vacant units, giving insights into rental opportunities and forecasting lease-up strategies.

View PDF

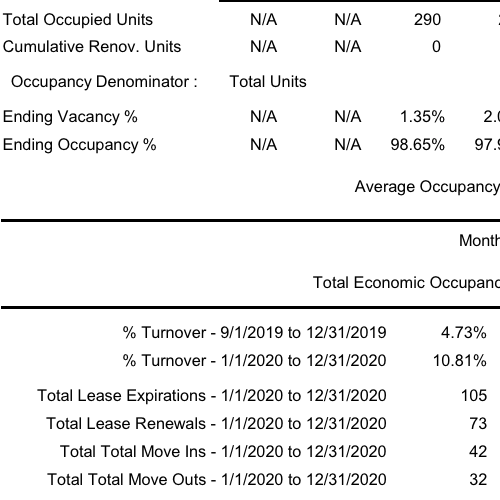

Occupancy Projections

Shows projected occupancy and vacancy percentages over an 18-month period, providing a strategic view of future leasing activities.

View PDF